02. Getting started - Buying Process

03. Downloading, Installing and Activating Burning Grid

04. Testing Burning Grid EA with Strategy Tester

05. Setting up Burning Grid on a Demo or Live Account

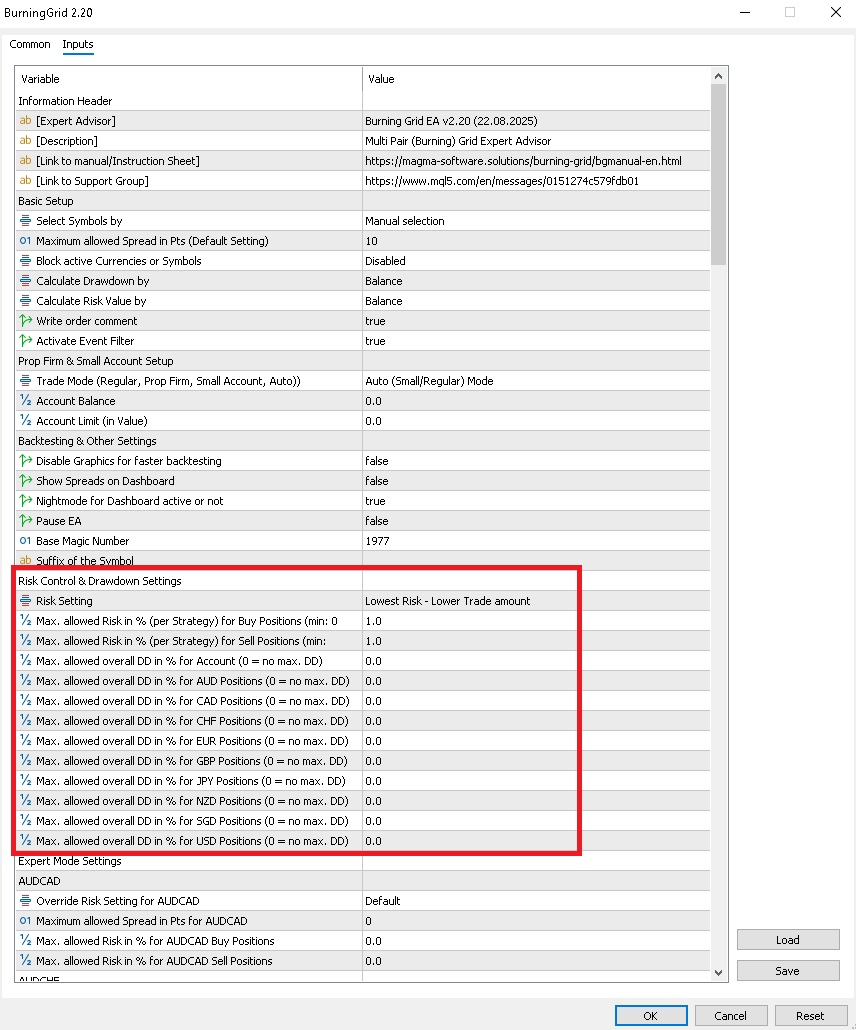

09. Backtesting & Other Settings

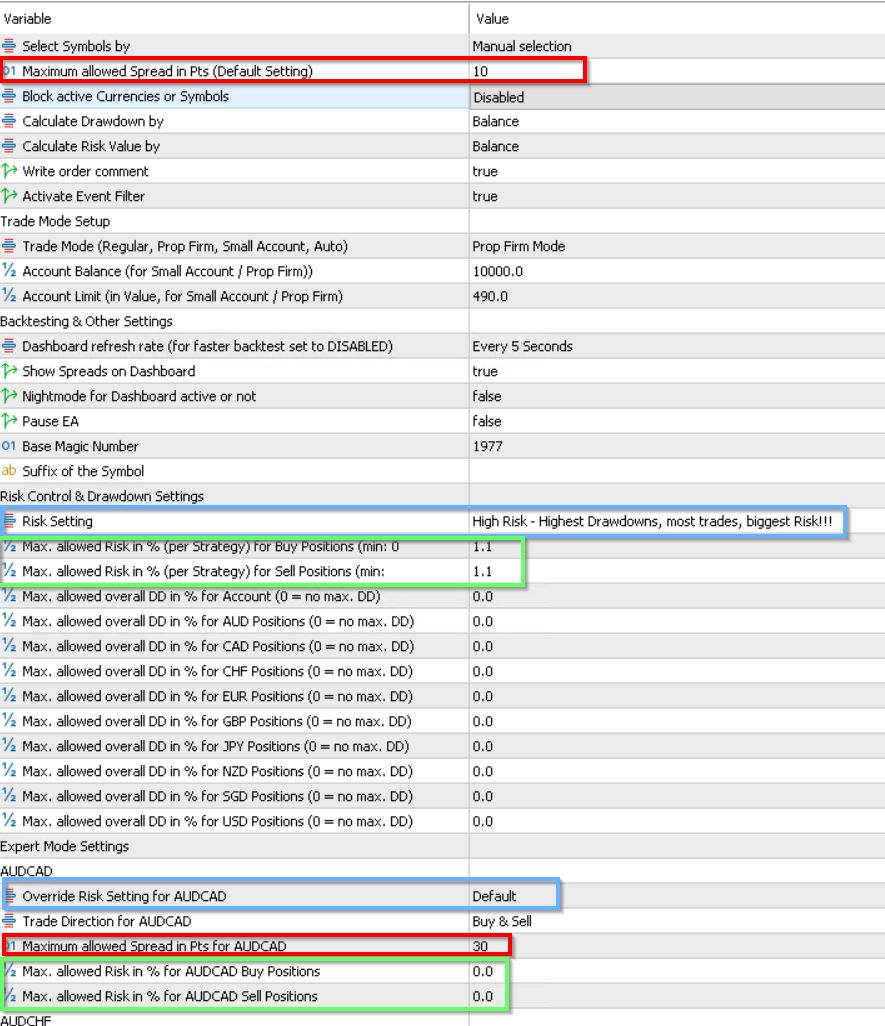

10. Burning Grid Settings for Experienced Users

12. FAQ - Frequently Asked Questions

Thank you for choosing this (Burning) EA (Expert Advisor).

If you have any questions, suggestions or comments, you can easily contact us via MQL5. You can also find all our products here: https://www.mql5.com/en/users/MagmaSoftwareSolutions/seller

This manual will guide you through all processes such as installation, configuration, and usage of the EA so that you can unlock its full potential. Please study this manual carefully in order to achieve a successful and smooth start with this product.

Should you still have questions or need help, simply join our MQL5 chat: https://www.mql5.com/en/messages/0151274c579fdb01

Congratulations on your decision to explore the world of Expert Advisors and indicators on the MQL5 marketplace! In this chapter, we will guide you through the most important steps to get started with these powerful tools and enhance your trading experience.

The MQL5 marketplace is a real treasure trove of trading tools and offers a wide range of Expert Advisors and indicators developed by experienced traders and programmers. Here you can find a list of all our products on the MQL5 market:

https://www.mql5.com/en/users/MagmaSoftwareSolutions/seller

Click the Buy button to proceed with your purchase.

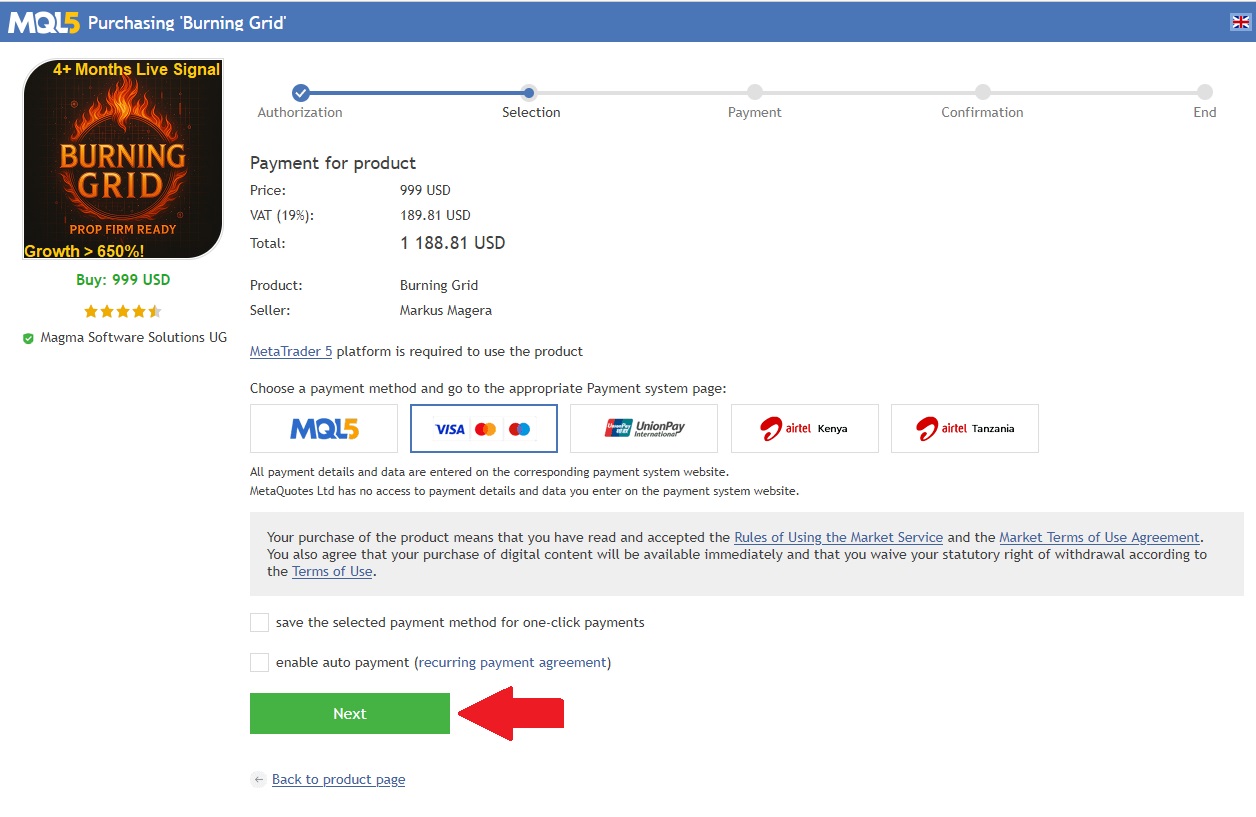

Select your payment method and then click the green Next button to proceed with your payment.

After your purchase is completed, you need to open your MT5 terminal to download and install the Burning Grid EA.

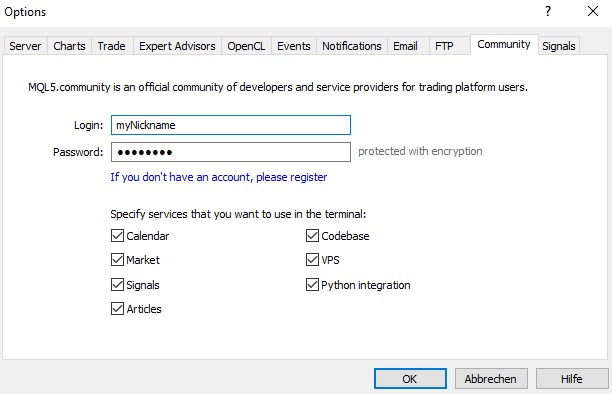

When you open the MT5 client, please make sure you are logged in with your MQL5 account. Use your MQL5 login (not your email) for this.

Open the MT5 terminal and go to “Tools -> Options -> Community” and make sure you are logged in there with your MQL5 account.

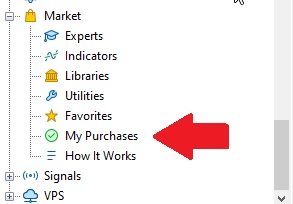

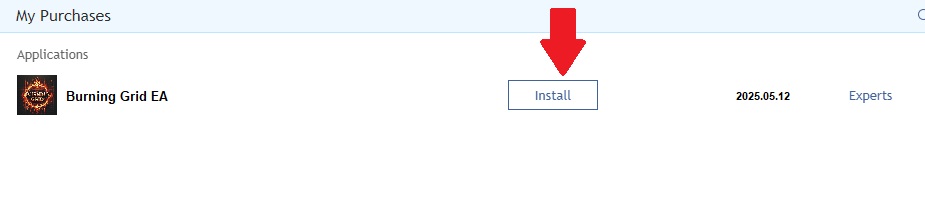

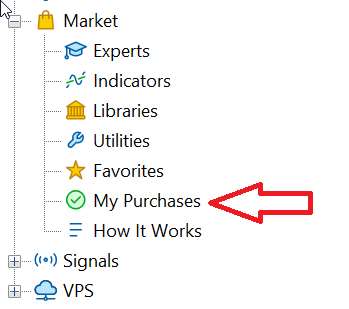

Then go to “View -> Navigator” and click on the Market folder and then on “My Purchases”.

The Purchases window with all your purchases will open on the right. Now click on the Install button for Burning Grid.

Please test your new Expert Advisor very thoroughly. Especially some settings depend on your broker (e.g., spread) and must be determined by you using the Strategy Tester!

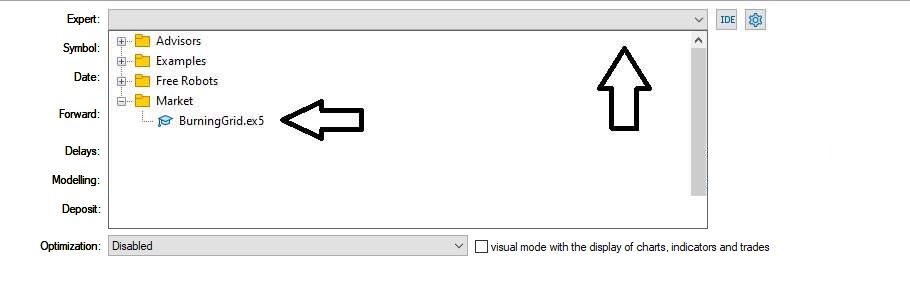

To use the Strategy Tester, click on “View -> Strategy Tester”.

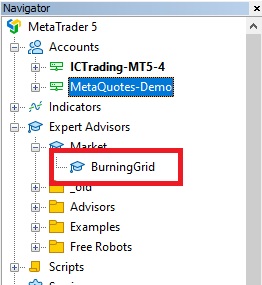

Now click on “Expert” and select Burning Grid here. You will find it under Market.

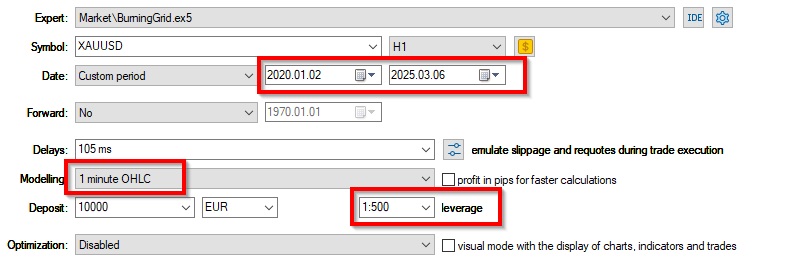

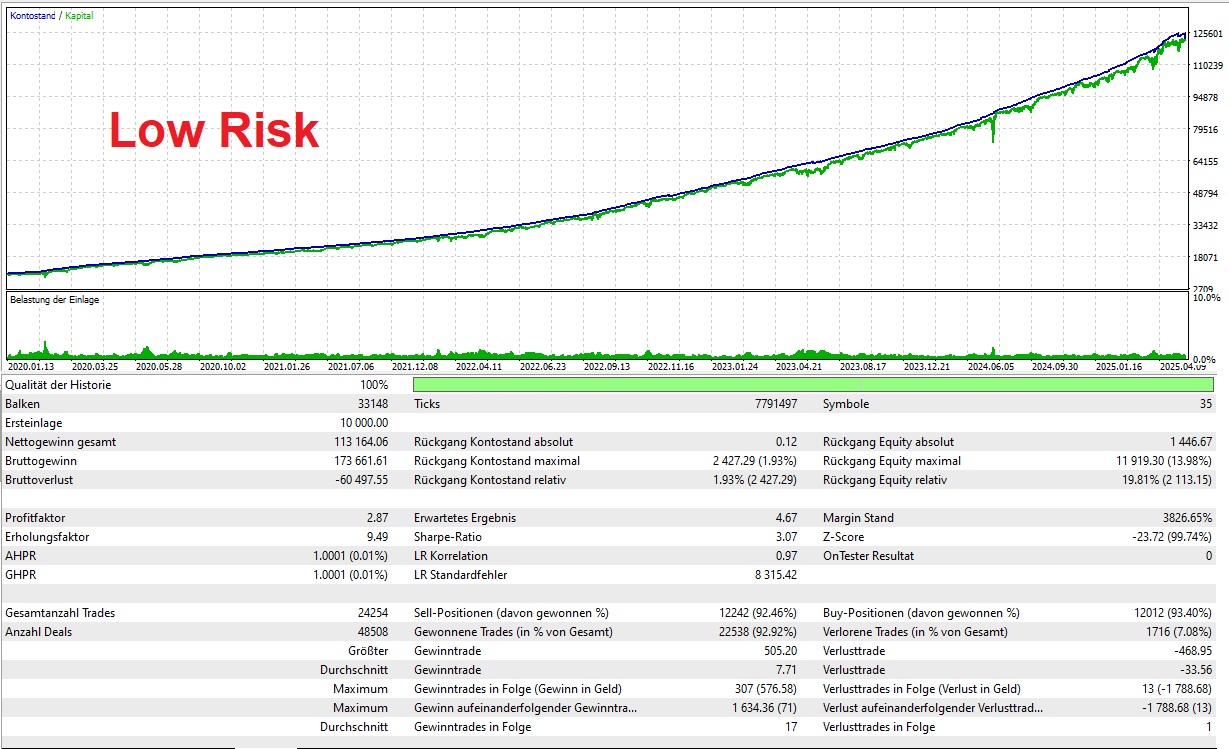

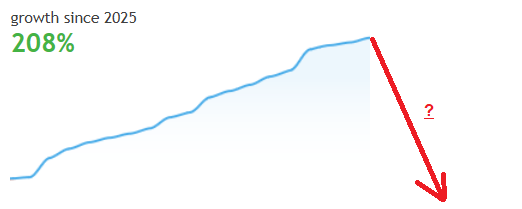

To test Burning Grid effectively, you should select a timeframe starting from 01.01.2020. Since most brokers do not offer test data for such a long period, we recommend selecting “1 Minute OHLC” for modeling. Also set the leverage offered by your broker. We recommend ICTrading, which in our opinion offers the best conditions on the market.

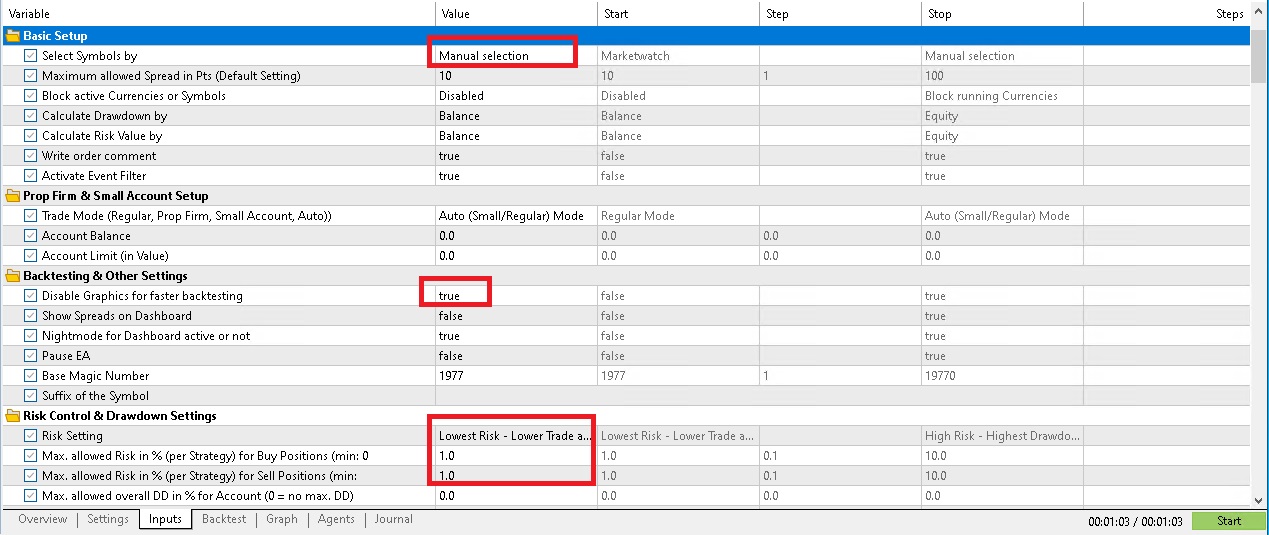

Then you can choose “Inputs” to configure Burning Grid for the first test.

For the first test, we recommend setting the Risk % to 1, disabling graphics for a faster test, and initially using only the “Lowest Risk” setting.

A more detailed explanation of what each setting does follows below.

Then click on “Start” to begin the test.

Since more than 30 currency pairs are processed in parallel during the test, it may unfortunately take several hours depending on the CPU. If graphics are enabled, the time required will increase again. Therefore, we recommend starting the test in the evening to check the result in the morning.

For various brokers (e.g., prop firms or trading capital accelerators such as iFunds), it may be necessary to perform a complete test.

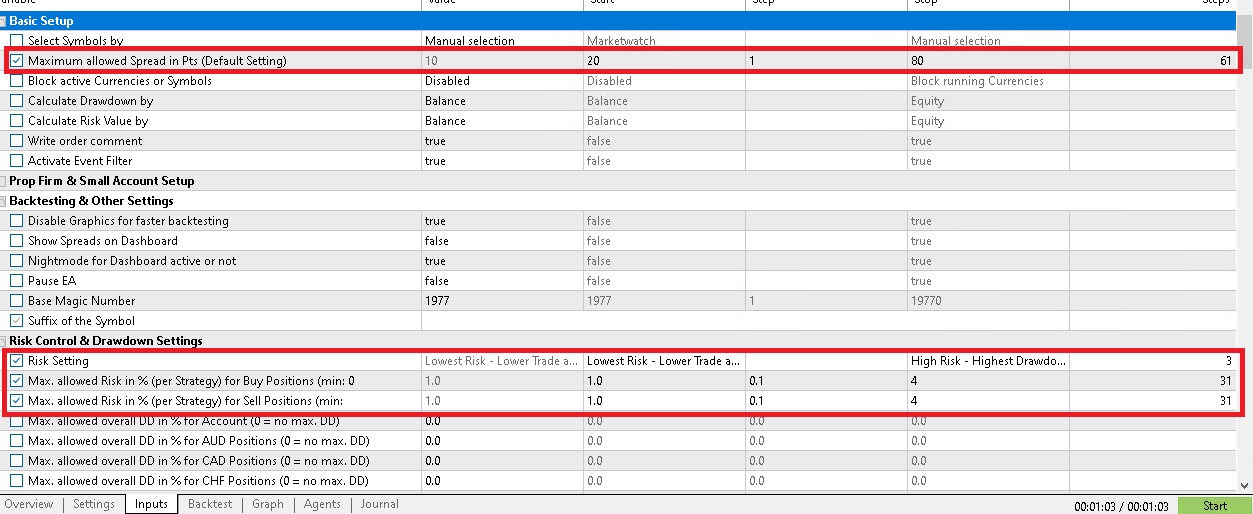

To do this, in the Inputs under the “Optimization” section, select the options “Slow complete algorithm” and “Drawdown min”.

In the Inputs of Burning Grid, now select the entries shown in the graphic to find the settings that comply with the rules of your capital accelerator.

In the example, over 80,000 tests are needed:

So be aware that this optimization will take a long time. But this ensures that the settings of Burning Grid can pass your challenges!

For regular brokers with low spreads, such as ICTrading, this test is generally not necessary, but it doesn’t hurt 😉

Now select from the list of results the one that does not exceed the maximum allowed DD of your capital provider (and ideally leaves some buffer).

After testing Burning Grid and finding the perfect settings for your broker or capital provider, we can burn down the market.

You can use the following steps for both demo and live account setups:

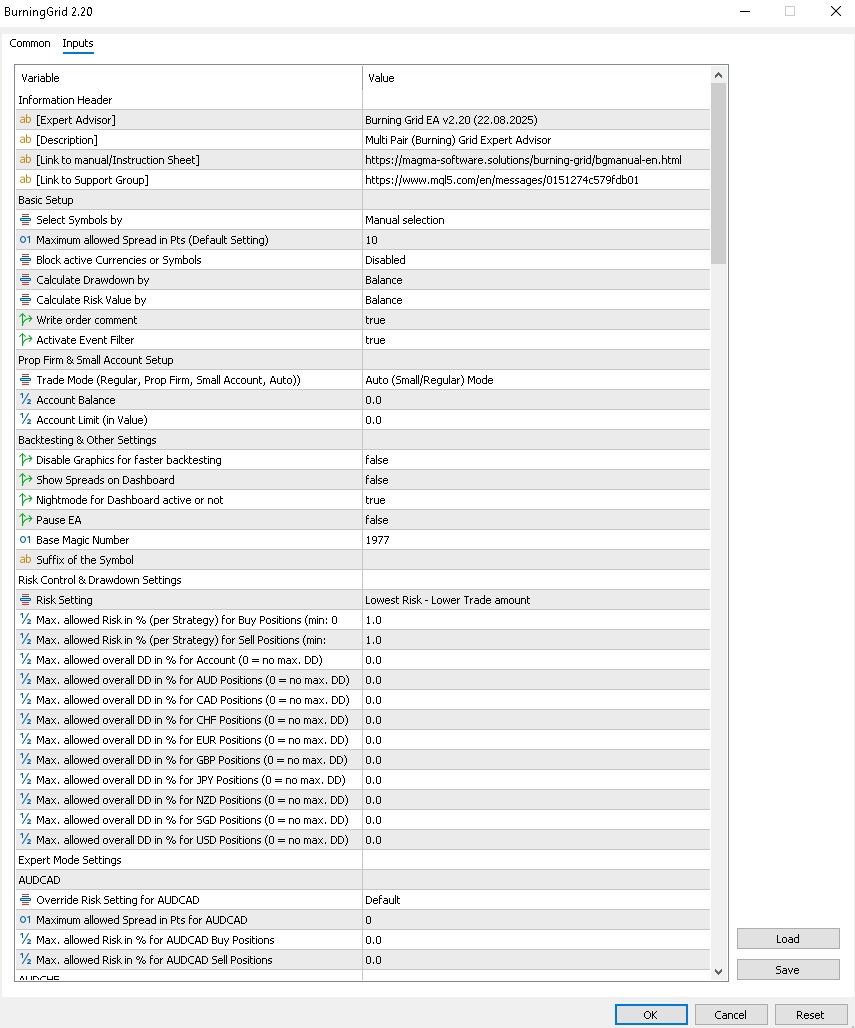

4. Click on Inputs. Here you can adopt the parameters from the tests (or use the default settings for a good broker)

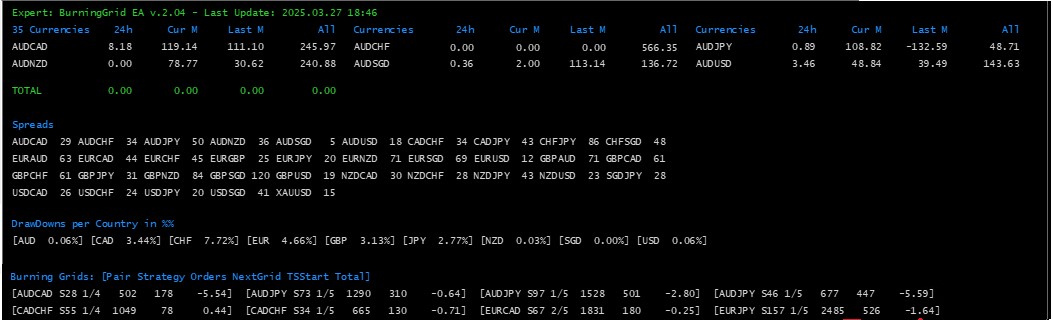

After one last click on “Ok”, Burning Grid will start and display the following dashboard:

At the top, the profits and losses achieved so far per pair are displayed. These are roughly totaled and shown for the last 24 hours, the current month, the previous month, and overall. Only symbols with positions closed by Burning Grid are listed here.

In the second section, the current spreads of the symbols are listed. This helps define the range for the spread in a backtest.

The third section shows the current drawdowns per currency, aggregated across all open positions.

The last section shows the current open positions (Burning Grids). These are grouped by strategy and symbol.

Burning Grid has a built-in risk management system based on the following factors:

Manual selection: only pairs marked with “On” are traded (choose this for backtests!)

Marketwatch: pairs found in the Marketwatch and processable by the EA are traded

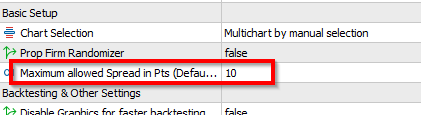

The maximum difference between Bid and Ask at which Burning Grid opens a new position.

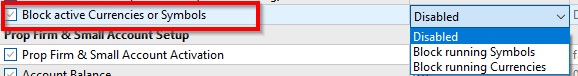

Disabled: All strategies which conditions are met can open their first position.

Block running Symbols: All strategies which conditions are met can only open their first position if there is no other strategy running with the same symbol (e.g.: no new AUDUSD strategy can enter if there is an already running AUDUSD strategy).

Block running Currencies: All strategies which conditions are met can only open their first position if there is no other strategy running with the same currencies (e.g.: no new AUDUSD or EURGBP and similar strategies can enter if there is an already running EURUSD strategy).

One Position per Level: For each Level in a strategy a new Position will be opened. Please check if your broker supports enough Positions!

One Position per Strategy: Each strategy has only one active Position. If a new Grid Leel is reached, the old Position will be closed and a new one with increased Lot Size for level will be ordered.

Balance: Balance is used to calculate the Drawdown

Equity: Equity is used to calculate the Drawdown

Balance: Balance is used to calculate the Risk value

Equity: Equity is used to calculate the Risk value

If set to “true”, all graphics (like the dashboard) are disabled, resulting in significantly faster test results.

If "false" no comment will be added to the order

If "false" the Event Filter is not used (not recommended!)

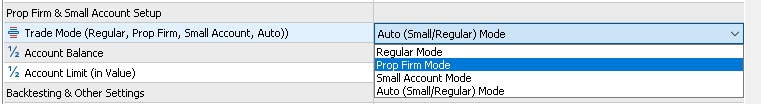

Here you simply choose the mode of this setting.

Recommended for accounts with >10.000 USD Balance.

Used for Prop Firms. Enter also Prop Firm Balance (starting balance of the account) and the max DD Limit (in value)

Used for lower Account (<10.000 USD). You can ask for Setfiles depending on your Account Balance!

Best suitable for small account users who don't want to switch setfiles (like in Small Account Mode). All needed settings are implemented in the EA.

Enter here the Balance of the Prop Firm at the beginning (or if you have a small account the balance of this account)

The maximum Limit the account is allowed to loose in this stage. E.g. if you use a Prop Firm where you are allowed to loose 500 Dollar in that stage at once, choose here 90% of that value (so 450). If you have a small account instead, choose about 50% of that account (250 if you have a balance of 500)

More infos about the modes can be found HERE

Choose here 1% for the Max. allowed Risk and High Risk in Multi Chart Risk Setting.

Every time a strategy is activated, a check is first carried out to determine whether its Risk% still fits within the prop firm limit. Example: The balance is USD 10,000, the prop firm limit is USD 450, and the Risk% is 1%. The strategy would therefore assume a maximum loss of USD 100. If no strategies have been activated yet, these USD 100 are now "blocked" and deducted from the USD 450. This leaves USD 350 for additional simultaneous strategies. When the strategy (the grid) is closed, these USD 100 are released from the calculation. However, if USD 400 was already blocked, the new strategy will NOT be activated, as the maximum of USD 450 would be exceeded! If your prop firm provider sets a daily loss limit of USD 500 in the stage, please select 90% of this (i.e. USD 450) and run an optimization test with the Risk%!

For an account with a small balance, select a Risk% appropriate for your account and your limit. We recommend a "Prop Firm Limit" of 50% of your account (250 for an account value of 500) and a Risk% appropriate to that (in the example with IC Trading, 6%). The Risk% is also best determined through an optimization test.

Disabled: No Dashboard - Best performance for backtests!

Every Tick: Dashbaord refreshes with every tick (most CPU Load)

Every Second: Dashboard refrehs every second

Every 5 Seconds: Dashboard refrehs every 5 seconds

Every 10 Seconds: Dashboard refrehs every 10 seconds

If “true”, the middle section of the dashboard is shown. If “false”, it is not.

If “true”, the Nightmode is applied to the Dashboard. If “false”, it is not.

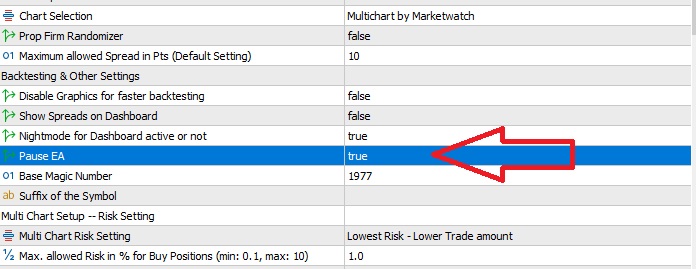

If “true”, existing open positions are processed (including rebuy), but no new strategies are triggered or opened.

The base magic number for Burning Grid. Important: a numerical range of ~300 is needed for the many strategies. So if the base magic number remains at 1977, the range up to 2277 will be used and should not be occupied by other Expert Advisors!

Some brokers have suffixes for the pairs (e.g., “.ix”). To ensure the symbol is recognized by Burning Grid, the suffix must be entered here.

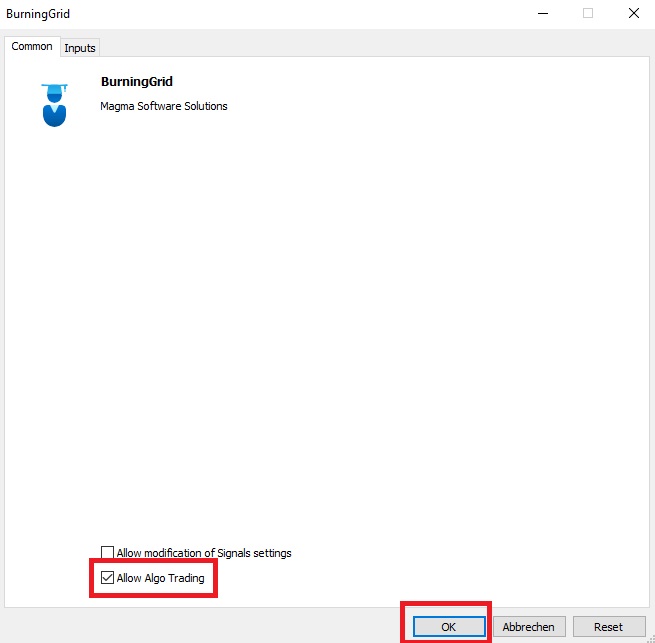

In order for Burning Grid to place positions, Algo Trading must be enabled in the terminal.

Please make sure your computer is ON 24/7! Since slippage and network issues can affect the performance of Burning Grid, we recommend using a VPS (Virtual Private Server), e.g., from Commercial Network Services. This way, you don’t need to have your computer on and monitor it constantly, but can run your EAs on a remote machine stress-free.

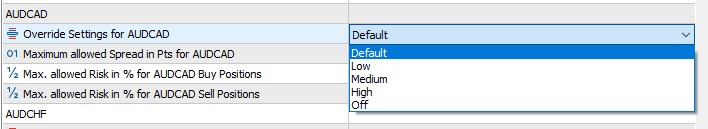

Experienced User who made a lot of backtests to find out the best for each pair setting on their broker, have the option to override some setting of the EA for a currency pair. The colored boxes show, which setting of the EA can be overruled by a currency pair:

On each pair the user can decide, if s/he wants to override the settings of the EA for that pair. The Combobox show the following possibilities:

Default: take the risk settings of the EA for that pair

Low: set the risk setting of that pair to Low and override the EA setting

Medium: set the risk setting of that pair to Medium and override the EA setting

High: set the risk setting of that pair to High and override the EA setting

Off: deactivate that pair (no trades!)

The settings for Spread and Risk% (Buy and Sell) work similar. If set to 0, the EA defined settings will be taken. If set to a different value, this pair will take those settings.

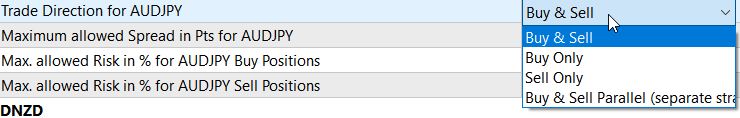

Additionally you can choose if the Pair should trade in both directions, only buy or only sell or in parallel.In the parallel mode it could be possible (by intention) that long running strategies in one direction (e.g. buy) will also open a trade in the other direction (e.g. sell)

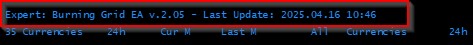

If there are no strategy adjustments, you can just update and attach the new Version to the existing chart. Afterwards, the new Version will load the existing Grids.

If there are strategy adjustments that can no longer process the currently open positions, all open positions should be closed.

To ensure that Burning Grid only handles currently open positions but does not open any new grids, you must switch Burning Grid to pause mode:

Afterwards, the top line will no longer be green but will be displayed in blue:

From this point on, only the open grids will be processed, but no new ones will be opened!

Alternatively, you can also close Burning Grid and manually close the open positions.

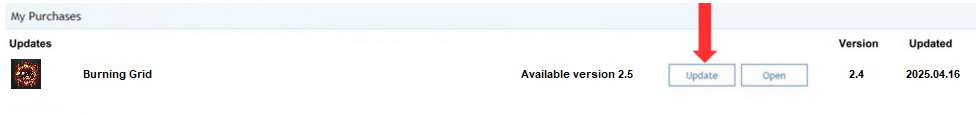

Once all open positions have been closed, go to the "Market" menu in MetaTrader and then to "My Purchases":

Then click on “Update” and follow the steps in “Setting up Burning Grid on a Demo or Live Account”:

If you are using the MQL VPS, you must migrate Burning Grid to the VPS afterwards!

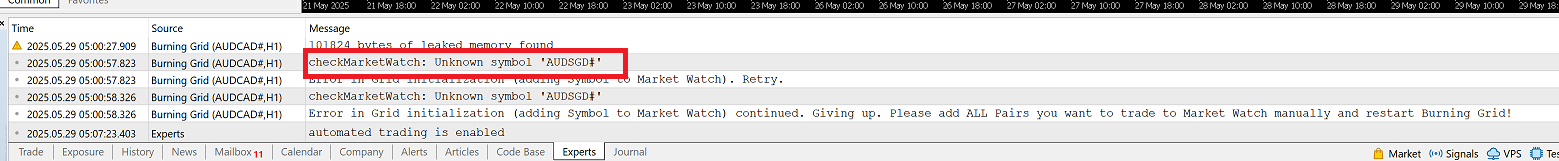

Question: When I attach Burning Grid to a chart or start if with the Tester i get an Error Message (OnInit returns non-zero code 1) and its not starting!

Answer: You are missing one or more symbols in the market watch or you have an active symbol in your test config your broker doesn't support. Burning Grid tries to add missing symbols to market watch, but sometimes the client is too slow or your broker is not offering the symbol. So either add the missing symbol, set it to Off in the configuration or switch Chart Selection to "Multichart by Marketwatch" (last only if not testing in strategy tester)

Question: Which chart and which timeframe do i have to choose?

Answer: Whichever you want. Everything needed is implemented in the EA!

Question: I tried a backtest / live demo but i didnt had any trades

Answer: This could happen if the spread of your broker is higher than the maximum allowed spread defined in the configuration. Please do an optimization backtest to find out, with which spread you can work on your broker or use a broker with spreads starting at 0! pips such as ICTrading. Another reason could be that you selected "Multichart by Marketwatch" in Backtest. Please choose here "Multichart by Manual Selection" cause otherwise the EA will only get the Symbol passed which you selected in the Backtest Settings.

Question: I see your live signals on Metatrader are starting with 500 Euro. Can i do the same and is it safe?

Answer: No, it is NOT recommended to use such a low capital. The signals must use real money. This is why they just started with 500 Euro. But with such low capital, the implied risk is much higher than the defined Risk% in the config. What does it mean? There is a minimum Lotsize (most brokers use 0.01 Lots). With 1% Risk Setting the calculated Lotsize could be just 0.002. But cause of the Minimum Lotsize its 5x higher. So you have an implied Risk of 5% per strategy and not 1%. So please do backtests to check how much capital you really need to survive and how much drawdown you can accept! If its too risky, deactivate some pairs which dont perform good enough or produce a too high drawdown!

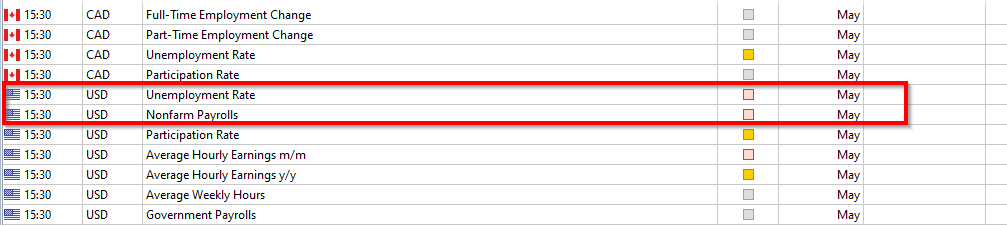

Question: I cannot see an option for an event filter (like deactivating on nfp). Is there something inside/implemented?

Answer: Short answer: yes :) Long answer: The metatrader client has an event calender implemented where you can see which event the next time(s) occur. In MQL5 (the programming language for MT5) you can read the entries of this calendar. For each running strategie, it is checking if there is a high or moderate event in place that can affect the symbol of the strategie. If so, 1h (for moderate) or 2h (for high impact) before or after that event, the strategie will not start an entry. If its already running, its ignoring the event filter. Example: in BG only USDJPY and EURAUD are active. Now nfp occurs, an high impact event for USD. All active strategies with USD in the symbol (here: USDJPY) will now pause starting from 2h before till 2h after the event occured. EURAUD is running like nothing happens (cause its not affected directly).

Question: Whats happening if i switch the Grid Level Mode with open Positions to "One Position per Strategy"?

Answer: First: nothing. If a new Rebuy should be executed, the running positions will be collected and closed. Afterwards one new position will be opened with the combined lotsize of the previous positions and the new grid lotsize.

Question: Whats happening if i switch the Grid Level Mode with open Positions to "One Position per Level"?

Answer: Also: nothing. If a new strategy is started, this Mode will apply. The existing and running strategies will still use the other mode.

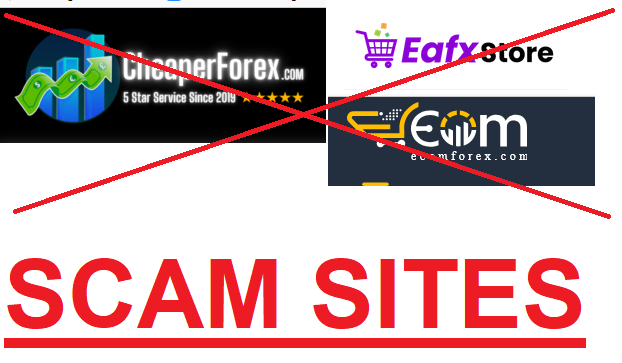

Question: I see your product is much cheaper on different websites? Why?

Answer: These are Scam sites. We only sell on the Metatrader Store! Offers on other websites are scams or fake products!

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The majority of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. There is a possibility to lose all your initial capital.

ICTrading is a trusted brokerage firm known for its robust suite of services in the Forex and CFD markets. Regulated by the Financial Services Commission (FSC) of Mauritius under license number GB21026834, the company operates with a strong commitment to security, transparency, and client protection.

Exceptional Trading Conditions

ICTrading stands out for offering highly competitive conditions tailored to both novice and experienced traders. With Forex CFDs starting from spreads as low as 0.0 pips, clients benefit from cost-efficient trading. Thanks to strategically placed servers in the NY4 data center, transactions are executed rapidly and without unnecessary delay—essential for capitalizing on market opportunities.

Flexible Account Options

To meet the varying needs of its clients, ICTrading provides three main account types:

Practice Without the Risk

For those looking to explore the platform or fine-tune their strategies, ICTrading also offers a risk-free demo account. This feature enables users to gain practical experience and test various trading approaches using real-time data—without putting any capital on the line.

Ready to get started?

Click this link to open your ICTrading account.

iFunds.io is a modern proprietary trading firm that offers traders a fast and flexible way to access capital. Unlike traditional funding models, iFunds.io removes the need for challenges or evaluations. Traders can begin trading with capital immediately—up to $500,000—allowing them to focus purely on performance from day one.

What Sets iFunds.io Apart

Account Options for Every Trader

iFunds.io offers a range of account sizes, each designed to suit different trading goals:

All accounts come with a 10% maximum loss limit, no daily drawdowns, and no time pressure or trading day minimums.

Extra Perks

iFunds.io empowers traders with capital, freedom, and opportunity—without the traditional roadblocks.

FTMO is one of the most recognized and well-established proprietary trading firms worldwide. It offers talented and disciplined traders the opportunity to trade with up to $200,000 in starting capital – and with consistent performance, even up to $400,000. What sets FTMO apart: there is no instant funding. Instead, the firm relies on a transparent, two-phase evaluation model that fairly assesses performance and risk management.

What Makes FTMO Stand Out

Account Types for Different Trading Styles

FTMO offers a range of account sizes, each designed to suit different trading goals:

Additional Advantages

FTMO offers ambitious traders a structured platform to trade with company capital and take their trading career to the next level.

Why Running a Forex EA on a VPS

For traders relying on Expert Advisors (EAs) in the forex market, operating through a Virtual Private Server (VPS) can make a world of difference. A VPS allows your trading system to function independently of your personal computer—meaning trades continue to be placed around the clock, regardless of local power outages or internet disruptions.

Because VPS hosting is optimized for speed, it significantly reduces latency, enabling quicker trade execution and minimizing slippage. Security is another major plus: by separating your trading environment from your personal device, you protect your strategy from viruses, malware, and system crashes.

In short, a VPS offers a stable, secure, and uninterrupted trading experience that’s essential for serious forex traders.

Why Many Traders Trust Commercial Network Services (CNS)

CNS is a top-tier VPS provider recognized in the forex community for its high-performance infrastructure and commitment to uptime.

Ready to level up your trading setup? Host your EA with CNS.